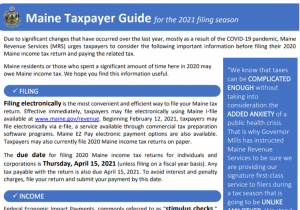

Taxpayer guidance from Maine Revenue Services

Maine Revenue Services (MRS) has opened e-filing for tax returns and published a Taxpayer Guide for the 2021 filing season that may be updated as the tax season continues.

Notable highlights in the provided guidance include:

Taxable income: Unemployment compensation

Maine unemployment compensation benefits, including any special unemployment compensation authorized under the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act, are subject to Maine income tax to the extent the benefits are subject to federal income tax.

Taxpayers must report the amount of unemployment compensation paid to the recipient during calendar year 2020, along with any other income and withholding, on their federal and state income tax returns.

Taxable income: Federal and state grants and loan forgiveness

To the extent included in federal adjusted gross income and not otherwise exempt from taxation under Maine law, grants and loan forgiveness are taxable to Maine. This may include special programs authorized under the federal CARES Act and grants received through the Maine Department of Economic & Community Development.

Statutory residency exceptions not extended during COVID

Certain individuals may be taxed as a Maine resident if they are considered a statutory resident, or an individual who maintained a permanent place of abode in Maine for the entire tax year and spent more than 183 days of the year in the State (unless the individual is in the U.S. Armed Forces). A permanent place of abode is not considered permanent if it is only maintained during a temporary stay in Maine for the accomplishment of a particular purpose. An individual who is domiciled outside of Maine but maintains a second home in Maine at which they stay during part of the year would not meet this exception, even during COVID-19.

Sales tax nexus: No substantial physical presence

MRS had previously announced that for sales occurring in 2020, MRS will not consider the presence of one or more employees in this State, who commenced working remotely from Maine during the state of emergency and due to the COVID-19 pandemic, to constitute substantial physical presence in this State for sales and use tax registration and collection duty purposes. This exclusion from the physical presence test has been extended to sales occurring in 2021.